Knowing how to manage your finances is a key skill for the future. Teens should not have to go through college debt and overdraft fees just because they were ill-informed. (Photo courtesy of Karolina Grabowska)

Money is the basis of the world and there is no arguing that. Unfortunately, many teenagers leave high school having no idea how to manage and save their money. This is not a shock since according to a survey done by Everfi in 2019, 65% of high school students left high school without taking a single personal finance course.

But you deserve to know how to be successful when you leave high school because no one wants crushing student debt or an inability to keep money in their pocket. So how better to solve this problem but with the absolute basics or personal finance?

Credit vs Debit: Is there actually a difference?

Now before you make the assumption that everyone knows how credit and debit cards work, they do not. According to a 2012 study completed by ING Direct found that almost a quarter of teens incorrectly assumed that using a debit card means borrowing the bank’s money.

So what is the difference?

Debit cards take money directly from your bank account and all of this money is what you own. They are a good safe bet for anyone who is just beginning to manage their money. The biggest con with debit cards is there is little fraud protection besides a pin number. If your debit card is lost or stolen, you could be responsible for any charges made.

On the other hand, credit cards draw money from a credit limit, and you have to repay what you borrowed because it is not technically yours. This is why credit cards are seen as risky for many people. “Don’t [use a credit card] unless you’re certain that you will be responsible enough to pay it off in full and not go into credit card debt, which has insanely high-interest rates” said Studyquill in her video titled the student guide to personal finance. But there are also benefits, such as fraud protection and the ability to build a credit history.

For a better understanding of the differences between these two payment methods, check out Get Schooled for a more detailed explanation.

Credit History and Scores

Credit history is formed whenever you use your credit card. Buy a pack of gum at CVS with your card, boom it is credit history. You want to develop a good and reliable credit history by paying any bills back on time and staying under your credit limit.

Positive credit history is critical so you can keep a high credit score.

Credit scores are three-digit numbers based on the information found on your credit reports that reflect your payment history, your debt, the age and diversity of your credit reports, and credit inquiries. Experian explains that the scores are between 300-850 in a series of ranges, with 850 being the highest score possible. Credit card companies use these scores to determine if you are a high or low-risk borrower.

High credit scores are essential for any large purchases in the modern world. Buying a car, paying off student loans, and even renting an apartment are all good examples of things you could need to use credit for. If you have a high credit score, the options you will have when you apply for credit will be much more available and affordable.

Budgeting Basics

Learning how to make a simple budget is probably one of the most important things to learn before becoming an adult. A spending plan helps you prioritize expenses, save for your future, and stay out of debt with just a little bit of thought.

“I am not telling you you have to micromanage every single dollar that you are spending, but it is important that you are mindful of where your money is going,” said YouTuber Studyquill in her video.

When creating a budget, the first step is to track your spending and categorize your purchases. This will give you a better idea of how much you spend on food, entertainment, etc. You also need to identify any income you have. The money can come from a job, birthdays, or even the $20 bill you found on the sidewalk yesterday.

After this data collection, you need to plan your expenses. There are fixed expenses that stay the same such as a car payment or insurance. On the other hand, there are also variable expenses such as gas, food, and entertainment. You need to plan where you can afford your fixed expenses and also have enough money left over for emergencies.

Budgets can be created in a variety of ways, but two good online resources are Mint and You Need a Budget.

Long- Term Saving

When it comes to long-term saving, investing is one of the best ways to save money. Many people think investing is only stocks and bonds, which is not 100% true. Stocks and bonds are very rewarding forms of investment but come with higher risks and are generally better for more experienced investors. If you are interested in these methods Nerd Wallet has a great beginners guide, but there are other options worth looking at.

Savings accounts are the safest and simplest way to save money. There is no risk of losing money, and you will receive interest each year. Unfortunately, with low risk comes low reward. The interest rates on savings accounts are pretty small. If that is your only form of investment, you will not gain a lot out of it.

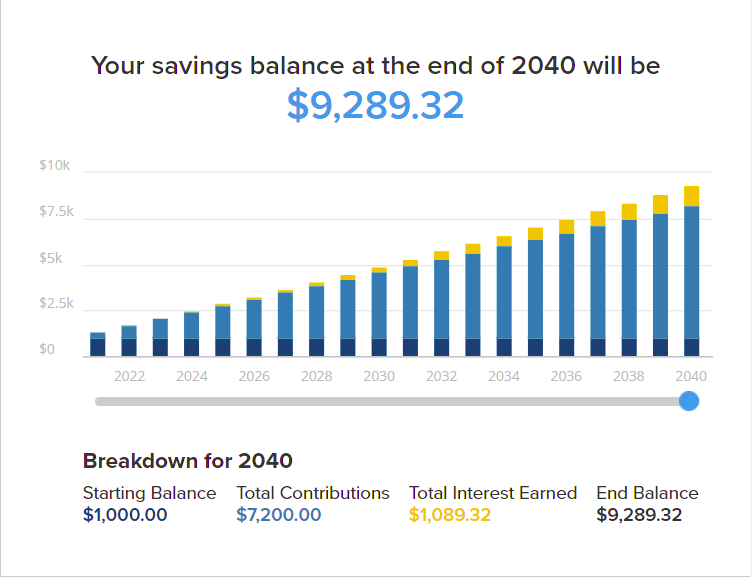

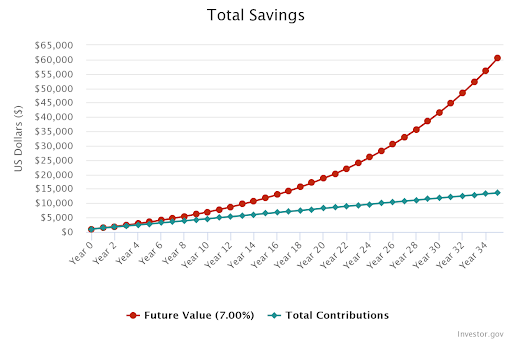

A huge way for teens to save is by creating an IRA or individual retirement account. Retirement accounts use a type of interest called compound interest, which is earning interest on interest. The money you put in cannot be accessed until you are 59 and a half, but there are exceptions like paying for college expenses and first-time home purchases.

If you believe it is too early to invest, your dead wrong. Time is the most crucial asset to investing and if you are not sure, plug some numbers into this Compound Interest Calculator and see what happens.

The world of finance is extremely confusing for many teenagers, especially if they do not have the chance to take a personal finance course. There are hundreds of ways to save, spend, and invest your money but it truly is not as difficult as it seems. Hopefully, this article has shed some light on how best to use your income and you will be inspired to take control of your own money.

Hi! My name is Cassidy and I am a staff writer for The Mycenaean. I am also a member of Book Club and Tech Theatre.

Leave a Reply